Investments, acquisitions and divestitures

In addition to innovations, investments and acquisitions make a decisive contribution toward achieving our ambitious growth goals. We are intensifying our investment in emerging markets and in North America. We use targeted acquisitions to supplement our organic growth.

€5,786 million

In investments made in 2015

€227 million

Used for acquisitions in 2015

Optimization

Of our portfolio through acquisitions and divestitures

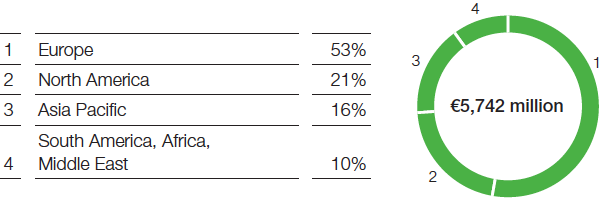

For the period from 2016 to 2020, we have planned capital expenditures1 of €19.5 billion. We want to invest more than a quarter of this amount in emerging markets and expand our local presence in order to benefit from the growth in these regions. In North America, attractive growth prospects and cost-effective raw material prices are strengthening our investment plans in the region. Furthermore, we are continuing to develop our portfolio through innovation-driven acquisitions that promise above-average profitable growth. Investments and acquisitions alike are prepared by interdisciplinary teams and assessed using diverse criteria. In this way, we ensure that economic, environmental and social concerns are included in strategic decision-making. We also continuously improve the efficiency of our production processes by investing in our plants.

1 Excluding additions to property, plant and equipment resulting from acquisitions, capitalized exploration, restoration obligations and IT investments

|

Investments and acquisitions 20152 (in million €) |

||||||

|

|

|

Investments |

Acquisitions |

Total | ||

|---|---|---|---|---|---|---|

|

||||||

|

Intangible assets |

|

135 |

136 |

271 |

||

|

Thereof goodwill |

|

– |

19 |

19 |

||

|

Property, plant and equipment |

|

5,651 |

91 |

5,742 |

||

|

Total |

|

5,786 |

227 |

6,013 |

||

Investments

- Investment volume exceeds prior-year level

- Several major plants begin operations

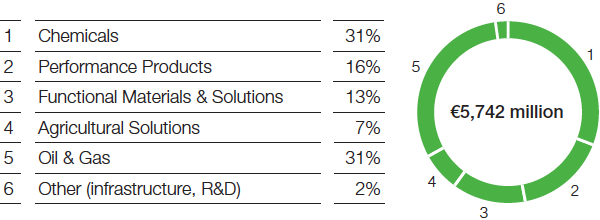

We invested €5,651 million in property, plant and equipment in 2015. Total investments therefore exceeded the previous year’s level by €283 million, due in part to currency effects. We presume that average yearly investment between 2016 and 2020 will be lower compared with 2015, after having started up operations at several major plants. Our investments in 2015 focused on the Chemicals, Oil & Gas and Performance Products segments.

In Ludwigshafen, Germany, we constructed an integrated TDI complex with a capacity of 300,000 metric tons per year and expanded the plants for its associated precursors. The gradual startup of the complex began in November 2015. TDI is an important basic chemical product that is used primarily for soft polyurethane foams.

The acrylic acid and superabsorbent production complex in Camaçari, Brazil, began operations in the second quarter of 2015, and the MDI plant in Chongqing, China, started up in August 2015. In Kuantan, Malaysia, we are building an aroma ingredients plant. The expansion of our Verbund site in Nanjing, China, is proceeding well. With these major investments, we are expanding our presence in the emerging markets of Asia and South America.

Together with Yara International ASA, based in Oslo, Norway, we began construction on an ammonia production plant in Freeport, Texas.

In the Oil & Gas segment, we invested primarily in field development projects in Argentina, Norway and Russia in 2015.

Investments Chemicals

Investments Performance Products

Investments Functional Materials & Solutions

Investments Agricultural Solutions

Investments Oil & Gas

Acquisitions

We gained €91 million worth of property, plant and equipment through acquisitions in 2015. Additions to intangible assets including goodwill amounted to €136 million.

In Taiwan on February 12, 2015, and on the Chinese mainland on December 1, 2015, we concluded the acquisition of the business of Taiwan Sheen Soon Co. Ltd. (TWSS), based in Lukang Town, Taiwan. TWSS is a leading manufacturer of precursors for adhesives based on thermoplastic polyurethanes.

On February 18, 2015, BASF took over technologies, patents and know-how for silver nanowires from Seashell Technology LLC, based in San Diego, California. Through this acquisition, BASF has extended its product portfolio for displays.

Effective February 24, 2015, BASF acquired a 66% share from TODA KOGYO CORP., based in Hiroshima, Japan, in a company to which TODA had contributed its business with cathode materials for lithium-ion batteries, patents and production capacities in Japan. The company will focus on the research, development, production, marketing and sales of a number of cathode materials.

On March 31, 2015, BASF concluded the acquisition of the polyurethane (PU) business from Polioles, S.A. de C.V., based in Lerma, Mexico. Polioles is a joint venture with the Alpek Group in which BASF holds a 50% share and which is accounted for using the equity method. The acquisition comprised marketing and selling rights, current assets, and to a minor extent, production facilities.

On April 23, 2015, BASF concluded an agreement with Lanxess Aktiengesellschaft, based in Cologne, Germany, on the acquisition and use of technologies and patents for the production of high-molecular-weight polyisobutene (HM PIB). The transaction furthermore includes the acquisition of selling rights and current assets as well as a manufacturing agreement in which Lanxess will produce HM PIB exclusively for BASF.

Divestitures

On March 31, 2015, we sold our business with white expandable polystyrene (EPS) in North and South America to Alpek S.A.B. de C.V., based in Monterrey, Mexico. The divestiture comprised customer lists and current assets in addition to production facilities in Canada, Brazil, Argentina and the United States. The share in Aislapol S.A., based in Santiago de Chile, Chile, was also sold to Alpek.

On June 30, 2015, we concluded the divestiture of our global textile chemicals business to Archroma Textiles S.à r.l., Luxembourg. The portfolio comprised products for pretreatment, printing and coating. The transaction furthermore involved the transfer of the subsidiary BASF Pakistan (Private) Ltd., based in Karachi, Pakistan, completed in the third quarter of 2015.

Effective July 1, 2015, we sold our 25% share in SolVin to our partner, Solvay.

On September 30, 2015, we concluded the sale of portions of the pharmaceutical ingredients and services business to Siegfried Holding AG, based in Zofingen, Switzerland. This involved the custom synthesis business and parts of the active pharmaceutical ingredients portfolio. The transaction comprised the divestiture of the production sites in Minden, Germany; Evionnaz, Switzerland; and Saint-Vulbas, France.

We concluded the sale of our global paper hydrous kaolin business to the Roswell, Georgia-based company Imerys Kaolin Inc. on November 1, 2015. The transaction involved the divestiture of the production site for kaolin processing in Wilkinson County, Georgia.

Asset swap

In the Oil & Gas segment, we concluded the swap of assets of equal value with Gazprom on September 30, 2015, with retroactive economic effect to April 1, 2013. The transaction gave BASF an economic share of 25.01% in blocks IV and V of the Achimov formation of the Urengoy natural gas and condensate field in western Siberia. Production is scheduled to start up in 2018.

In return, BASF transferred its share in the previously jointly operated gas trading and storage business to Gazprom. Gazprom furthermore became a 50% shareholder in Wintershall Noordzee B.V. in Rijswijk, Netherlands, which is active in the exploration and production of natural gas and crude oil deposits in the North Sea.