Functional Materials & Solutions

3rd Quarter 2017

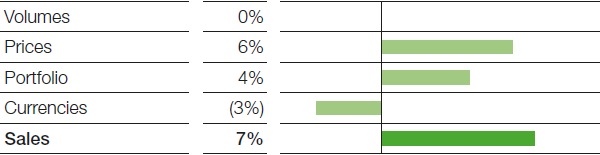

In the Functional Materials & Solutions segment, sales grew considerably compared with the third quarter of 2016. This was attributable to higher prices as well as the Chemetall business, which was acquired from Albemarle in December 2016. Sales volumes matched the level of the prior-year quarter: These rose in every division except Catalysts, where we posted a considerable decline in precious metal trading volumes. Compared with the third quarter of 2016, we were able to further expand our sales volumes to the automotive and construction industries. Sales were slightly weighed down by currency effects. Income from operations (EBIT) before special items was considerably below the level recorded in the prior-year quarter. Earnings were dampened primarily by lower margins resulting from higher raw materials prices.

Factors influencing sales, Functional Materials & Solutions

3rd Quarter 2017

Catalysts

Sales in the Catalysts division declined slightly as against the prior-year quarter. This was attributable to lower volumes, predominantly in precious metal trading, as well as negative currency effects. Overall, we recorded significantly higher sales prices on the back of an increase in precious metal prices. Sales generated by precious metal trading decreased to €532 million (prior-year quarter: €614 million), mainly due to lower volumes. EBIT before special items declined considerably. This was primarily the result of higher fixed costs, due among other things to new production facilities.

Construction Chemicals

In the Construction Chemicals division, sales rose slightly compared with the third quarter of 2016. The acquisition of Henkel’s western European building material business for professional users in early 2017 and the slight growth in volumes were responsible for this development. We increased volumes significantly in Europe as well as in Asia, especially China and Japan. Volumes rose slightly in the region South America, Africa, Middle East and decreased slightly in North America. Prices remained stable overall; sales were reduced by currency effects in all regions. EBIT before special items was down considerably on the level of the prior-year quarter, mainly as a result of higher raw materials prices.

Coatings

Sales in the Coatings division rose considerably as against the third quarter of 2016. This was largely attributable to the Chemetall business, which was acquired in December 2016, as well as higher sales volumes. Overall, we recorded slightly negative currency effects. Sales of refinish coatings were lifted slightly by volumes growth in Asia and Europe, while overall sales of automotive OEM coatings remained on a level with the prior-year quarter. EBIT before special items saw a considerable margin-related decline.

Performance Materials

Higher prices and volumes led to considerable year-on-year sales growth in the Performance Materials division. In contrast, currency effects had a negative impact. Sales prices increased, particularly in Europe and Asia. Volumes growth was mainly driven by the polyurethane systems, thermoplastic polyurethanes and engineering plastics businesses. Demand from the automotive, consumer goods and construction industries developed positively. There was a considerable decline in EBIT before special items. This was primarily attributable to lower margins as a result of higher raw material prices as well as to a rise in fixed costs, partially in connection with new production facilities.

|

|

3rd Quarter |

January – September |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

2017 |

2016 |

Change % |

2017 |

2016 |

Change % |

||||

|

|||||||||||

Sales to third parties |

|

4,975 |

4,660 |

7 |

15,434 |

13,771 |

12 |

||||

Thereof Catalysts |

|

1,506 |

1,552 |

(3) |

4,869 |

4,527 |

8 |

||||

Construction Chemicals |

|

618 |

606 |

2 |

1,824 |

1,768 |

3 |

||||

Coatings |

|

951 |

790 |

20 |

2,948 |

2,328 |

27 |

||||

Performance Materials |

|

1,900 |

1,712 |

11 |

5,793 |

5,148 |

13 |

||||

Income from operations before depreciation and amortization (EBITDA) |

|

527 |

631 |

(16) |

1,799 |

1,981 |

(9) |

||||

Amortization and depreciation1 |

|

170 |

139 |

22 |

494 |

506 |

(2) |

||||

Income from operations (EBIT) |

|

357 |

492 |

(27) |

1,305 |

1,475 |

(12) |

||||

Special items |

|

(40) |

(5) |

. |

(45) |

(13) |

. |

||||

EBIT before special items |

|

397 |

497 |

(20) |

1,350 |

1,488 |

(9) |

||||

Assets (September 30) |

|

17,135 |

13,804 |

24 |

17,135 |

13,804 |

24 |

||||

Investments including acquisitions2 |

|

285 |

184 |

55 |

642 |

446 |

44 |

||||

Research and development expenses |

|

106 |

94 |

13 |

315 |

285 |

11 |

||||