Segment Profile

The Industrial Solutions segment consists of the Dispersions & Pigments and the Performance Chemicals divisions. The segment develops and markets ingredients and additives for industrial applications, such as fuel and lubricant solutions, polymer dispersions, pigments, resins, electronic materials, antioxidants, light stabilizers, oilfield chemicals, and mineral processing and hydrometallurgical chemicals. We aim to drive organic growth in key industries such as automotive, plastics, electronics, and energy and resources, and expand our position in value-enhancing additives and solutions by leveraging our comprehensive industry expertise and application know-how.

Divisions

Dispersions & Pigments

Raw materials used to formulate products in the coatings, construction, paper, printing and packaging, adhesives and electronics industries

Performance Chemicals

Customized products for various customer industries such as chemicals, plastics, consumer goods, energy and resources, as well as automotive and transportation

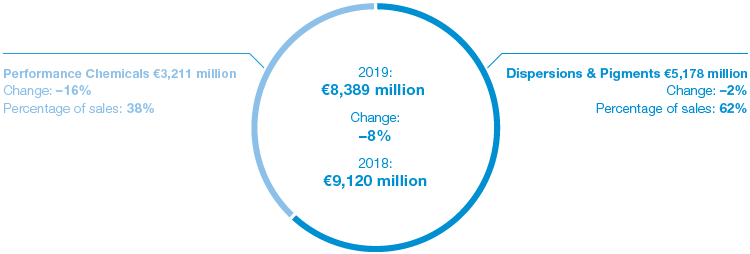

Sales

Factors influencing sales

Income from operations before special items

Million €

How we create value – an example

Alcotac®

Use of organic binders reduces inorganic betonite binder usage in iron ore pelletization

Value for BASF

Expected annual sales growth

> 25%

Value for the environment

Reduction of sulfur dioxide emissions

up to 25%

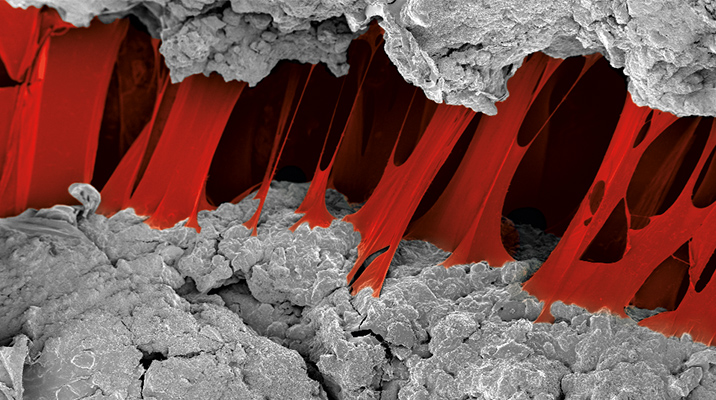

The market for binders used in the agglomeration of mineral substrates, for example to create iron ore pellets, has a current total volume of around €600 million. Betonite-based binders currently make up more than 90% of the entire market. As part of its Alcotac® product line, BASF has now developed novel polymer binding agents that offer better dose efficiency and can be used as co-binders together with conventional betonite binders. BASF strengthens its market presence with the organic Alcotac® binders and aims to generate annual sales growth of more than 25% over the coming years.

Iron ore pellets are still usually made using conventional betonite binders. However, this produces undesirable contaminants such as silicon dioxide and sulfur. The use of only small quantities of Alcotac® products as co-binders can reduce betonite usage by up to 60%. The organic binder leaves virtually no residues in the firing process. This increases the quality and thus the value of the iron ore and can reduce sulfur dioxide emissions by up to 25%.

Strategy

- Tailor-made products and solutions improve our customers’ applications and processes

- Global presence ensures reliable supply to customers in all regions

We take on the challenges posed by important future issues, especially population growth: scarce resources, environmental and climatic stressors, greater demand for food and the desire for better quality of life. In doing so, we focus on research and development and maintain close relationships with leading companies in our customer industries. We position ourselves globally to reliably supply customers in all regions. We invest in the development of innovations that enable our products and processes – as well as our customers’ applications and processes – to make a contribution to sustainability: for example, by allowing resources to be used more efficiently.

Our products create additional value for our customers and enable market differentiation. We develop new solutions together with our customers and strive for long-term partnerships that create profitable growth opportunities for both parties. Efficient production setups, backward integration in our Production Verbund’s value chains, capacity management, and technology and cost leadership are essential here.

We support our customers by serving as a reliable supplier with consistently high product quality, good value offerings and lean processes. We draw on our in-depth application knowledge and technological innovations to strengthen customer relationships in key industries.

We are increasing global production capacity for the antioxidant Irganox® 1010 by 40% through production increase projects at our sites in Jurong, Singapore, and Kaisten, Switzerland. With the start of production in Kaisten in 2019 and Jurong in early 2021, BASF aims to better serve the growing demand from customers in Asia and Europe, the Middle East and Africa.

We launched our Glysantin® branded engine coolant products in the North American automotive market in January 2020. Capital investments at our production site in Cincinnati, Ohio, are underway, adding to our global footprint, which includes sites in Europe, Asia and South America.

In 2019, we doubled the production capacity for the adhesive raw material acResin® with the startup of a second production facility in Ludwigshafen, Germany.

To provide a reliable supply of high-quality dispersions solutions in the growing ASEAN, Australian and New Zealand markets, we plan to double the production capacity for acrylics dispersions in Pasir Gudang, Malaysia. The new line will be operational in 2020.

On January 31, 2019, BASF and Solenis completed the transfer of BASF’s paper and water chemicals business to Solenis as announced in May 2018. Since February 1, 2019, we have held a 49% share in Solenis, which is accounted for using the equity method.

On August 29, 2019, BASF and DIC, Tokyo, Japan, reached an agreement on the acquisition of BASF’s global pigments business. The assets and liabilities to be divested were reclassified to a disposal group in the Dispersions & Pigments division as of this date. The transaction is expected to close in the fourth quarter of 2020, subject to the approval of the relevant competition authorities.